Navigating the world of medical billing can be complex. Denial Code 97 is a common hurdle in this process. It signifies a claim denial due to non-covered services. Understanding this code is crucial for healthcare professionals and billing specialists.

Denial Code 97 often stems from policy exclusions or limitations. Knowing the specific reason for the denial is key to resolving it.

Effective communication with insurance providers can clarify these denials. This code can impact revenue cycles if not addressed promptly.

Appealing Denial Code 97 requires proper documentation and evidence. Familiarity with insurance policies can prevent future occurrences.

This guide will help you understand Denial Code 97 and improve your claims management.

What is Denial Code 97?

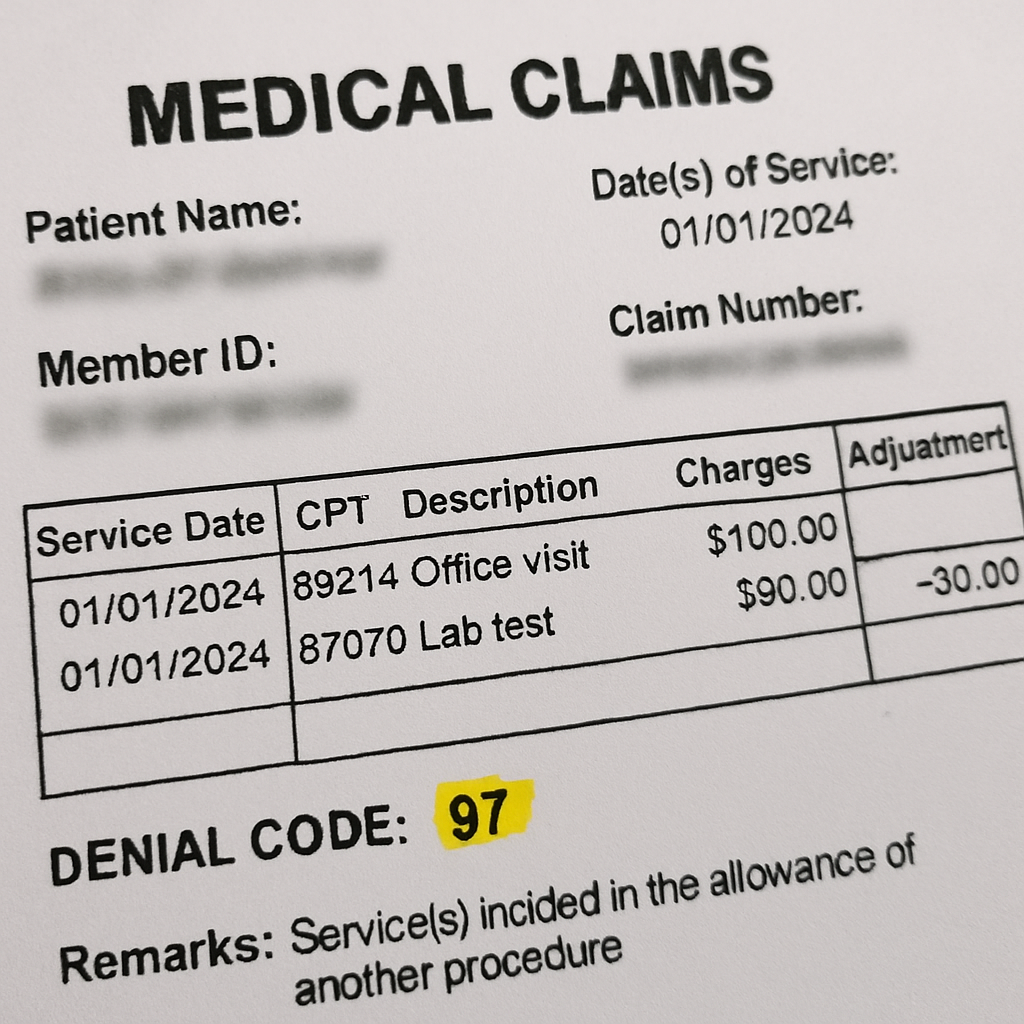

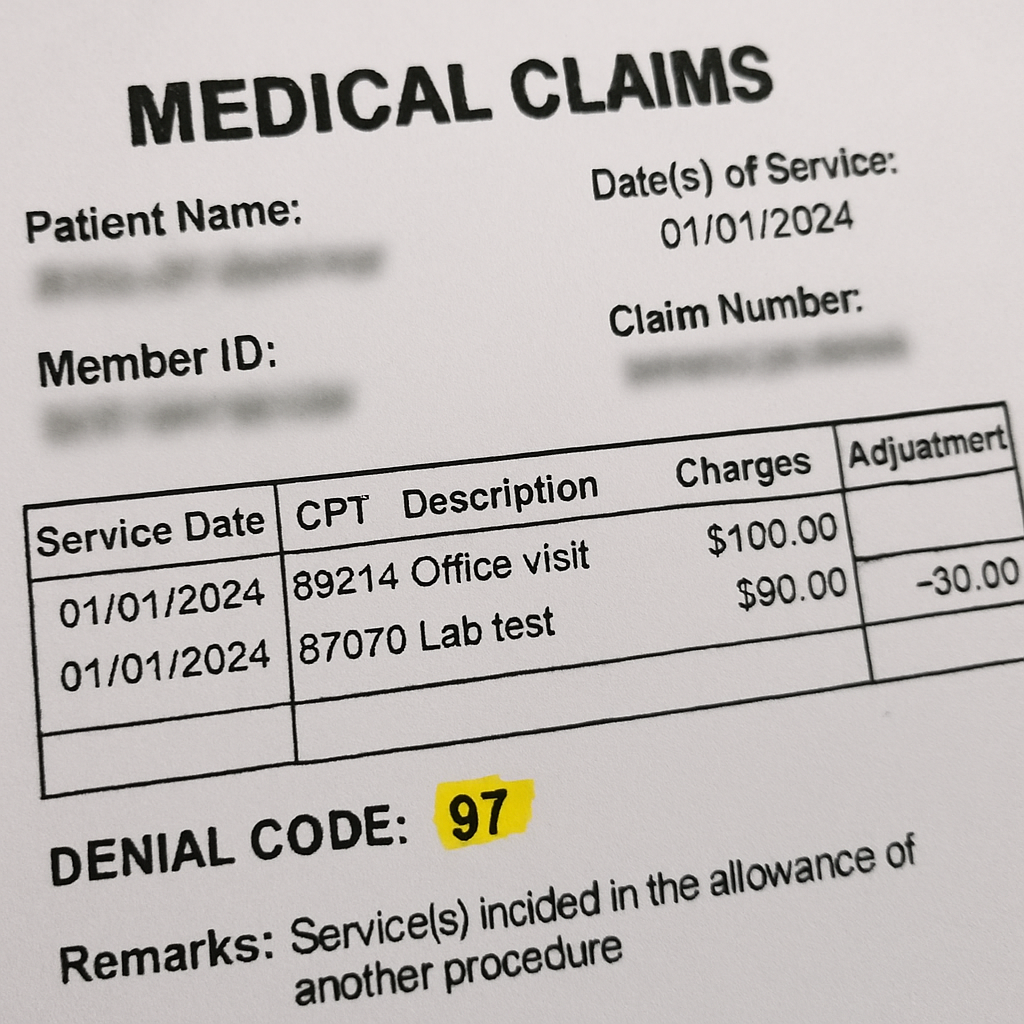

Denial Code 97 is a frequent obstacle in the medical claims process. This code indicates that a service is not a covered benefit under the patient’s insurance policy. It is part of the Contractual Obligation (CO) group of denial codes.

Medical billing professionals encounter this code when a claim is denied due to coverage issues. Understanding it is vital to ensure efficient billing practices. Each insurer may have unique guidelines, adding to the complexity.

The specific reasons for Denial Code 97 can include:

- Policy exclusions for the service or procedure.

- Failure to obtain prior authorization.

- Incorrect coding or billing errors.

These scenarios highlight the importance of meticulous claim preparation. Awareness of this code helps in identifying denial patterns. By paying attention to policy details and coverage limits, billing errors can be minimized.

CO 97 Denial Code Description and Reasons

The CO 97 denial code description helps reveal why claims get rejected. Understanding this description can assist in resolving and preventing future occurrences.

At its core, the denial reason 97 denotes that the billed service is outside the patient’s covered benefits. This could mean the service is excluded by the policy or wasn’t authorized in advance.

Key reasons for CO 97 denial include:

- Service or procedure not covered by the policy.

- Lack of prior authorization.

- Incorrect service code used.

A missing or improper request for prior authorization is a frequent cause. Each insurer may have specific procedures for authorization, impacting claim outcomes.

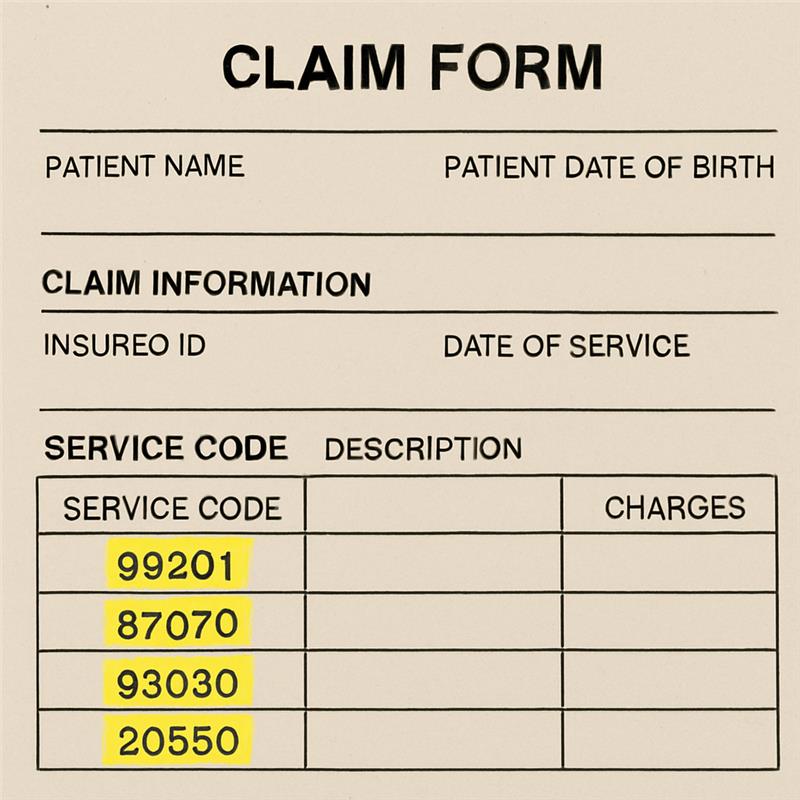

Incorrect coding also plays a significant role in CO 97 denials. Accurate coding is crucial for claims success and avoidance of denial code co 97.

Being aware of these reasons is essential. Recognizing them allows billing professionals to improve claim success and reduce rejection rates, ensuring smoother financial operations. Understanding insurer rules helps navigate these issues effectively.

Common Scenarios for Denial Code 97

Denial Code 97 often appears in certain predictable situations. Recognizing these can aid in managing and avoiding future claim denials.

Some typical scenarios where 97 denial code might arise include:

- Services rendered without verifying coverage beforehand.

- Procedures or treatments requiring prior authorization that weren’t obtained.

- Use of outdated or incorrect procedural codes.

Providing services without confirming coverage limits often leads to denial code co 97. Accurate eligibility checks can prevent many denials.

Another common issue occurs when the procedural codes used are outdated or incorrect. Ensuring the latest codes are used can minimize claim rejections due to this denial reason 97. Understanding these scenarios allows for proactive problem-solving and enhanced claim management.

How to Identify and Interpret Denial Code 97

Identifying Denial Code 97 involves carefully examining the claim’s Explanation of Benefits (EOB). The EOB often outlines why services were not covered, citing claim denial codes used by insurance.

To interpret this denial reason:

- Review the policy for coverage limitations.

- Check if the service requires prior authorization.

- Ensure the claim’s coding is accurate.

Understanding co 97 denial code descriptions help in pinpointing exact issues. This aids in rectifying and resubmitting claims with fewer errors. Communication with the insurer is also crucial to gain insights and avoid future occurrences.

Steps to Resolve Denial Code 97

Resolving Denial Code 97 demands a strategic approach. The first step is to carefully scrutinize the denial notification and the Explanation of Benefits (EOB). This review helps identify the co 97 denial code reason and specific issues leading to the denial.

Once the reason is clear, gather all necessary documentation to support an appeal. This may include medical records, communication logs, and policy documents that verify coverage. Proper documentation strengthens your appeal case.

Next, contact the insurance company to discuss the denial. Speaking with a representative can provide clarity on denial reason 97. It’s also an opportunity to correct any potential misunderstandings or administrative errors.

Submit an appeal if the denial was due to incorrect interpretation or any error. Ensure that your appeal contains all required information and adhere to the insurer’s appeal process guidelines. A well-prepared appeal increases the chances of a favorable outcome.

Lastly, if denied again, engage in further dialogue with the insurer and consider involving the patient in discussions. Continuous follow-up can sometimes lead to a resolution.

Preventing Denial Code 97 in Future Claims

Preventing Denial Code 97 involves proactive steps to streamline the claims process. Start by verifying patient benefits and coverage beforehand. This ensures that the services are covered under the patient’s plan, reducing the risk of denial.

Accurate coding and billing are crucial. Ensure that the procedure and diagnosis codes are correct and match the patient’s insurance policy. Missteps in coding often lead to claim denial.

Educate your team on common denial codes and insurance protocols. Knowledgeable staff can spot potential issues before submissions, increasing claim acceptance rates.

Additionally, ensure pre-authorization for services that require it. This is especially true for high-cost procedures or those frequently denied.

Key preventive measures include:

- Thorough benefit verification

- Regular staff training

- Accurate and complete documentation

- Pre-authorization for necessary services

By focusing on these areas, organizations can reduce the likelihood of encountering Denial Code 97 in future claims.

Key Takeaways and Best Practices

Understanding Denial Code 97 can enhance billing efficiency and claim success rates. Effective communication with insurers is vital for resolving denials efficiently. Familiarity with insurance policies also plays a significant role in preventing rejections.

Focus on proactive denial management strategies. Implement regular audits and staff training to keep your billing practices sharp.

Best practices include:

- Verifying benefits thoroughly

- Ensuring coding accuracy

- Maintaining open communication channels with insurance providers

Implementing these practices reduces the incidence of Denial Code 97 and leads to smoother claims processing.

Frequently Asked Questions about Denial Code 97

What causes Denial Code 97?

Denial Code 97 typically stems from claims involving non-covered services or incorrect billing practices. Understanding the denial’s context is crucial for resolution.

How can Denial Code 97 be prevented?

Proactive measures are the best defense. Proper benefit verification, accurate coding, and clear communication with insurance providers can all help minimize the occurrence of this denial code.

FAQs include:

- Why was my claim denied with code 97?

- How can I appeal a Denial Code 97?

- What steps should be taken to avoid future denials?

Comments are closed